How to e filing income tax India 2022 | www.income tax.gov.in

The process of filing Income Tax India Returns (ITR) via the internet is known as E-filing. The process of e-filing ITR is fast, and simple and can be done at the convenience of a person’s office or home. Filing an ITR electronically could also assist in making savings since you will not require hiring an individual to file the ITR.

It is now possible to complete your tax returns via the New Income Tax Portal. The New portal is equipped with many features that are created to simplify the taxpayer’s tax-filing process.

What Is Income Tax?

Table of Contents

The term”income tax” is a reference to a tax that is imposed by governments on the income earned by businesses as well as individuals who are within their region of control. Under the laws, taxpayers must prepare an annual tax return to calculate their tax obligations.

Income taxes provide government revenue. They are used to pay for public services, cover the government’s obligations, and to offer goods to citizens.

KEY TAKEAWAYS

- Income tax is one type of tax that is imposed by governments on income earned by companies and individuals in their area of control.

- The tax on income is used to pay for public services, cover government obligations, and to provide services to citizens.

- Tax on personal income is one type of tax on income taxed on a person’s wages or salaries as well as other forms of income.

- Business income taxes are applicable to partnerships, corporations small-sized businesses, individuals who are self-employed.

India Income tax login :- How I file income tax return

The process of filing income tax returns (ITR) through the internet is known as E-filing. The procedure to file ITR is fast, simple and can be done in the comfort of one’s office or at home. Filing an ITR electronically could also assist in making savings since you will not need to employ an individual to file the ITR.

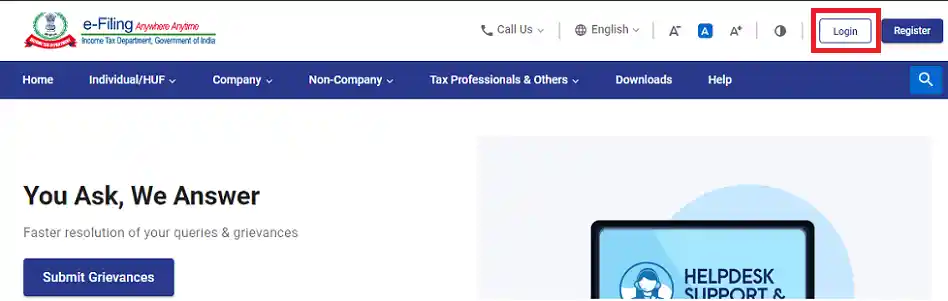

How to Register or Login on www.income tax.gov.in

- Visit the e-filing website https://www.incometax.gov.in/iec/foportal

- Create an account or register to file your tax returns electronically

- If you already registered through the portal before then click the “Login Here” button.

- If you aren’t yet registered your account on the website, click the “Register” button.

- Click on the ‘Taxpayer’ tab and then enter the information of your PAN. Then click on “validate”. Then, click on Continue’.

- Give details like your address, name as well as gender, residence status, birth date and more.

- Enter your email address and mobile number registered.

- When the questionnaire is completed Click on Continue.

- It is your responsibility to confirm the information following which a 6-digit one Time Password (OTP) is delivered to your mobile number registered and email address.

- Enter your OTP follow the steps provided to complete the registration successfully.

- After the OTP is verified, a new page will appear where you need to confirm the details supplied by you. If you find that any of the information is incorrect, you may alter it, and after that the new OTP will be issued to confirm the new information.

- The last step will be to create an account username and password.

- Select ‘Register and you will receive an acknowledgement email confirming that registration was successfully completed.

Steps how to e-file Income Tax Returns Online

Calculate your tax obligation for income in accordance with the rules of the tax on income laws.Use the form 26AS to summarize your TDS tax payment for the four quarters of the assessment year.

Based on the definitions given by the Income Tax Department (ITD) for each ITR form, you must determine the category you are a part of and then select an ITR form that is appropriate to your situation.

You must follow the directions below to electronically file the income tax return through the Income tax e-filing website:

Step 1: Go to the Official Income Tax E-filing site and click on the “Login” button.

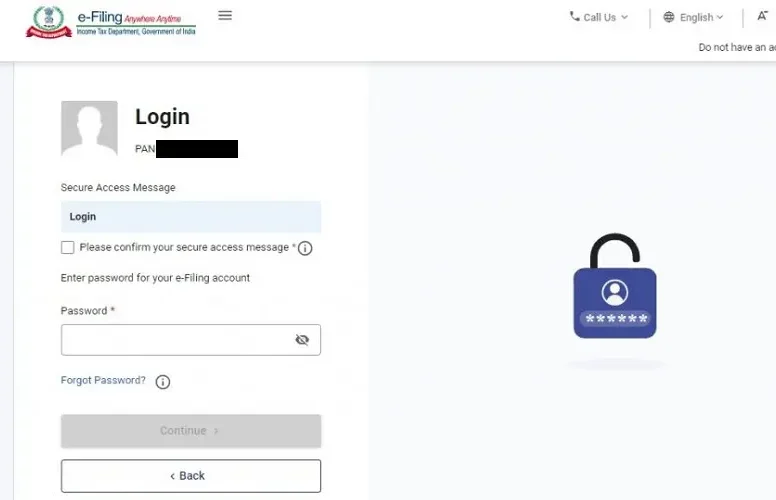

Step 2: Then, Enter Username then Click continue , and then Enter your Password.

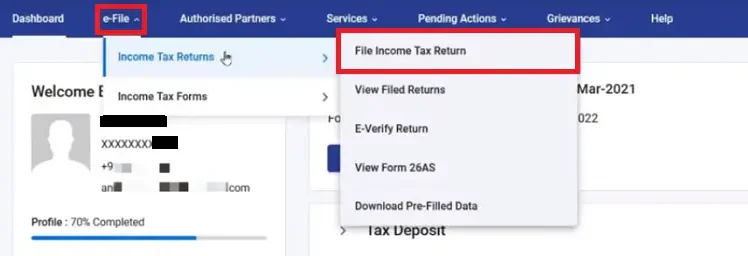

Step 3: Once you’ve entered this portal click the tab ‘efile’ and then select “File Income Tax Return”.

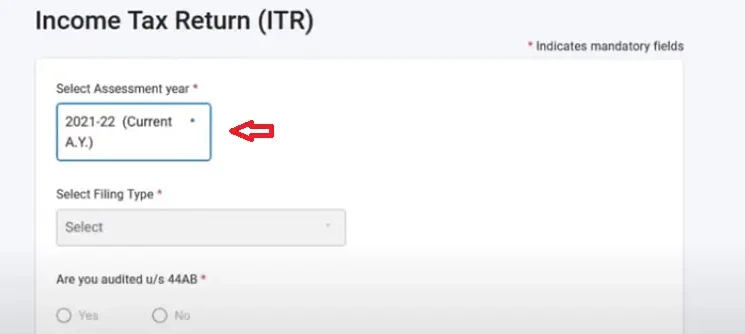

Step 4: Choose the year of assessment for which you want to complete your tax returns for income and then click “Continue”.

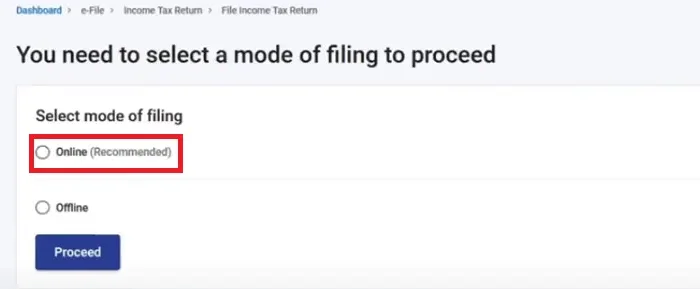

Step 5: You’ll be asked if would like to file your tax returns either online or offline. If you do, then you will need to pick the former option, which is also the preferred method of tax filing.

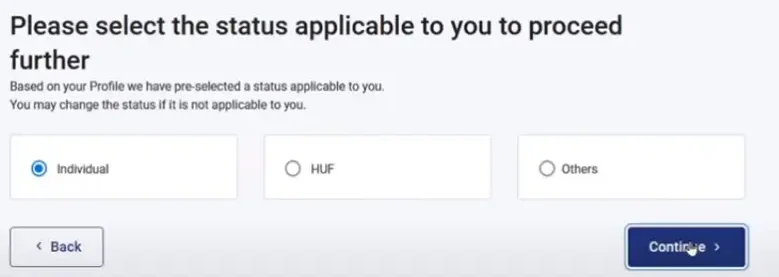

Step 6: Select whether you want to complete your income tax returns for yourself, Hindu Undivided Family (HUF) or any other. Select the option “individual”.

Step 7: Select the tax returns for income (ITR) you’d like to submit. For instance, ITR 2 can be filed by HUFs and individuals who do not earn earnings from their profession or business. If it’s the individual filing for tax, they could select either ITR1 and ITR4. In this case, you must click on ‘Proceed to ITR1’.

In Step 8: the following step will ask you to provide the justification for filing returns beyond the exempted basic limit, or in accordance with the seventh provision of Section 139(1). In accordance with the section, when the total amount of money deposited by an individual is greater than Rs.1 crore in any of his current accounts throughout the calendar year, and exceeds Rs.2 lakh for an overseas trip or if a cash payment in excess of Rs.1 lakh is made on electric bills, then the person is entitled to file their taxes on income. Be sure to select the appropriate option.

Step 9: Enter the information for the bank account you have. If you’ve already filled in the bank details for your account, then you can pre-validate it.

Step 10: After that, you’ll be taken to a new page where you can file your tax returns for income. The page will include lots of information that has been already filled. Review them to ensure that all information is exact. Verify the summaries of your tax returns and verify the information.

Step 11: Final step: check your tax returns and submit a hard copy of it you have them to the Income Tax Department. Verification is a requirement.

Note: rate of surcharge of Income Tax for foreign companies is lower than the Surcharges on Individuals since Domestic companies as well as Foreign companies are already charged an additional rate of income tax when compared to individuals. The rates of income tax are listed on this page – The Income Tax rates in India

how to file an ITR Offline to Super Senior Citizens

The super senior citizen (individuals who are older and over) are allowed to submit an ITR offline throughout the fiscal year. Another scenario where ITR is filed off-line is when a person or HUF earns an income that is less than Rs.5 lakh and isn’t eligible to get the refund.

The step-by-step process to download offline file returns is explained in the following paragraphs:

- Individuals have to request the Form 16.

- The next step is to submit your ITR returns on paper form to the Income Tax Department.

- After the form is filled out, you will receive an acknowledgement receipt by The Income Tax Department.

FAQs on how to file an ITR

- 1. What is the best offline method to file an ITR?Taxpayers can fill out an ITR offline using the aid of the upload XML method.

- 2. What is the manual procedure to file an ITR offline?The taxpayer needs to select and download the correct income tax form. Complete the required information and then convert the file into XML Format. Upload the XML file to IT portal. Choose one of the verified methods Aadhaar OTP, EVC or hand-signing a ITR V copy to CPC.

- 3. What are the various types of forms that are provided under the income Tax Law?The various forms offered under the income Tax Law are ITR1, ITR2, ITR3, ITR4, ITR5, ITR6, ITR7 and ITR-V.

- 4. Do I need to include any other documents with my tax returns for income?You do not have to provide any documentation when filing the income tax returns. But, the required documents have to be saved and provided to tax authorities upon request.

- 5. Do The Income Tax Department provide the electronic filing utility?Yes, the electronic filing utility is provided to taxpayers by the Income Tax Department. Returns that are electronically filed can be produced and later distributed electronically.

- 6. How can you tell the differences between electronic payment and E-filing?Electronically filing the tax returns is called electronically filing. E-payment refers to the tax-paying online with the use of State Bank of India’s debit or credit card or online banking.

- 7. Do I have to worry about criminal charges if my tax returns for tax-deductible income are not completed?If tax is not paid, you could have to pay extra interest, penalties, or even be charged. Based on what amount of taxes to be paid out, penalty may differ.

Read More :-